Simple, Consistent, Differentiated Strategy in Net Lease Real Estate

Long Term Leases. High Credit Quality. Durable Industry Sectors.

Our portfolio is built upon great real estate tenanted by cycle-tested, resilient companies.

INDUSTRIAL

NECESSITY RETAIL

QUICK SERVE RESTAURANTS

SERVICE ORIENTED

MEDICAL

EDUCATION

Target Total Return

15%

Cash Yield (Annualized)

7%

First Private Real Estate Fund Designed for RIAs and Individuals

Secure Online Portal

Integrations with major custodians

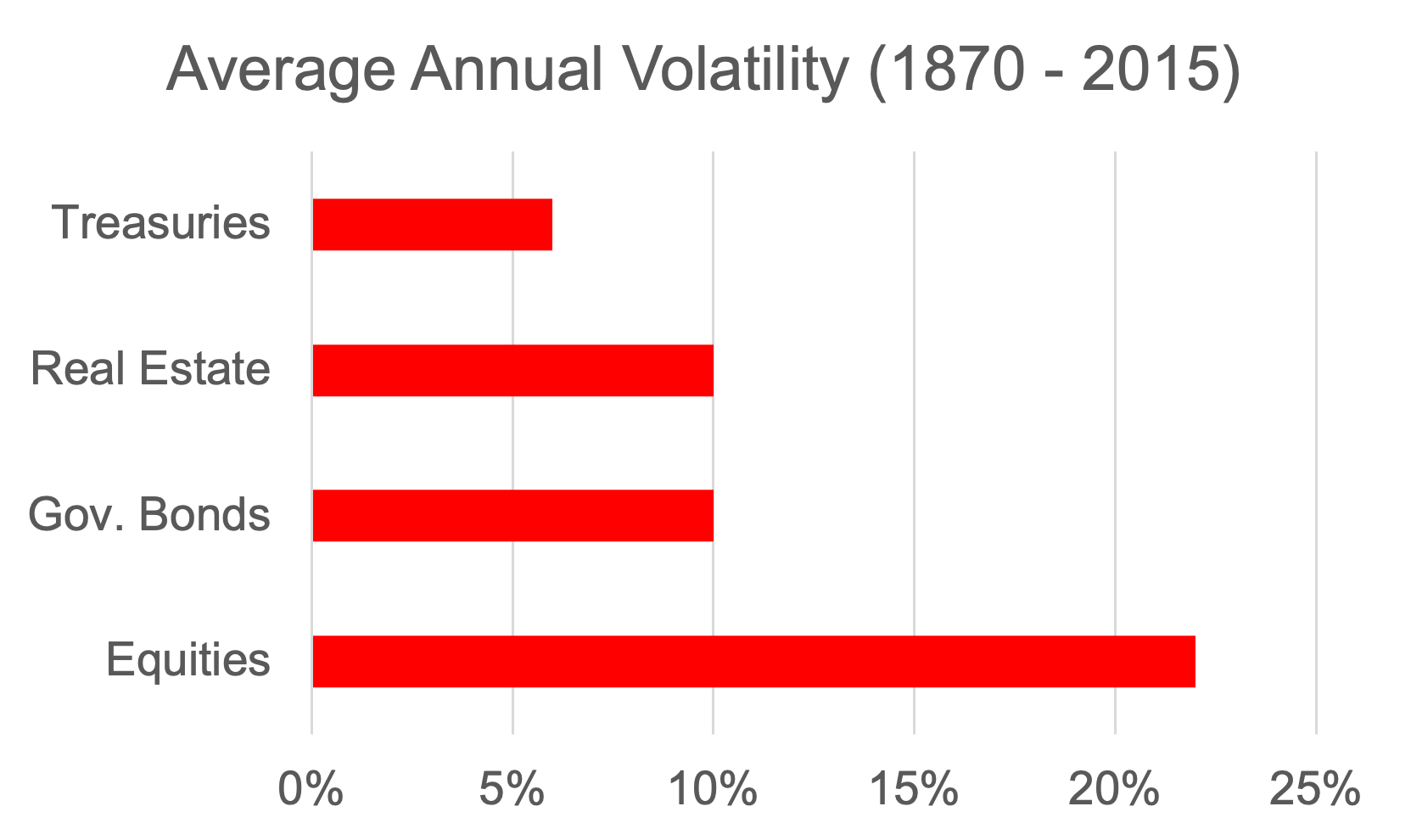

Strong net returns, often exceeding equities

Income generation that beats bonds

Not correlated with stock market sentiment

Lower volatility

We improve portfolios

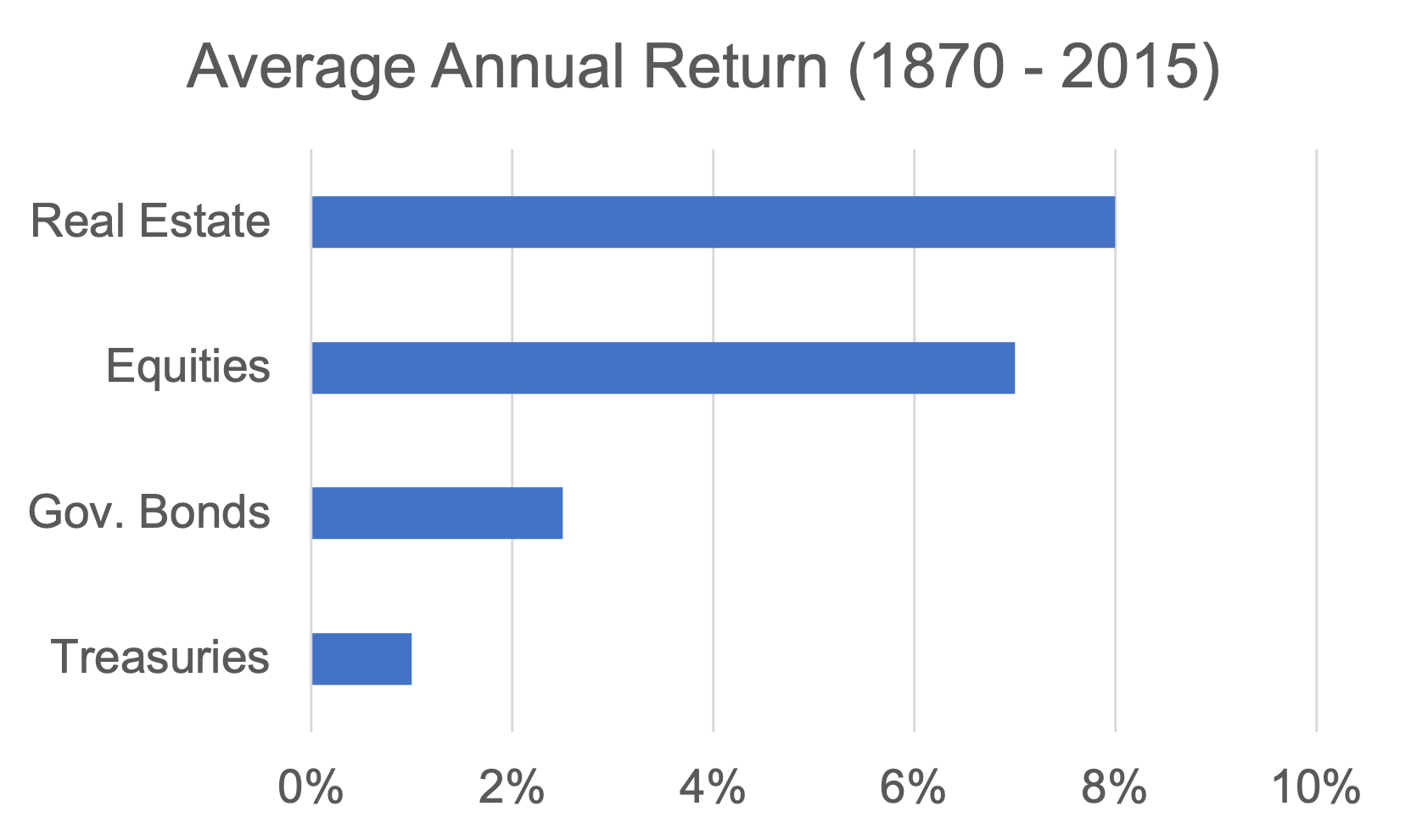

Why Real Estate?

The Numbers Speak for Themselves

SOURCE: Jorda, O. et al. "Rate of Return on Everything, 1870-2015." Quarterly Journal of Economics. Vol. 134. Issue 3. Aug 2019

Key Takeaways

Highest average annual return over the past 150 years

Stocks are twice as volatile as real estate

Allocation to real estate will improve long-term returns, generate income and reduce portfolio volatility

Prairie Hill net lease is the best version of real estate

Why Net Lease Real Estate?

Tenants pay the property taxes, maintenance and insurance

Credit quality - Investment Grade (IG) or IG-Quality

Net lease properties generate a reliable income stream with minimal volatility

Long Term Leases

The Prairie Hill Criteria:

Predictable income generation that is tax-protected

Engineering strong returns in relation to risk assumed by sourcing properties in situations where market & structural inefficiencies are high

Defensive tenancy in necessity-based industries

Cycle-tested tenants that can withstand recession and maintain durable cashflow

Cutting Out the Middlemen

Most private real estate funds rely on multiple layers — sponsors, property managers, and external operators — each adding costs that eat into returns. Prairie Hill integrates everything in-house.

No stacked fees

Full alignment across investment & operational functions

More income flowing to investors

Our market advantage

We operate in a unique corner of the market: properties valued between $5–25 million. Too large for most individual investors, too small for mega-funds, these assets don’t receive a level of interest commensurate with their high level of quality. Prairie Hill capitalizes on this inefficiency — acquiring properties that are undervalued on their own, but far more valuable when rolled into a portfolio.

The result is outsized returns on lower-than-assumed risk.